NEED HEALTH INSURANCE? SHOP OUR PLANS.External Link

ICHRA: A Smart Alternative to Group Insurance

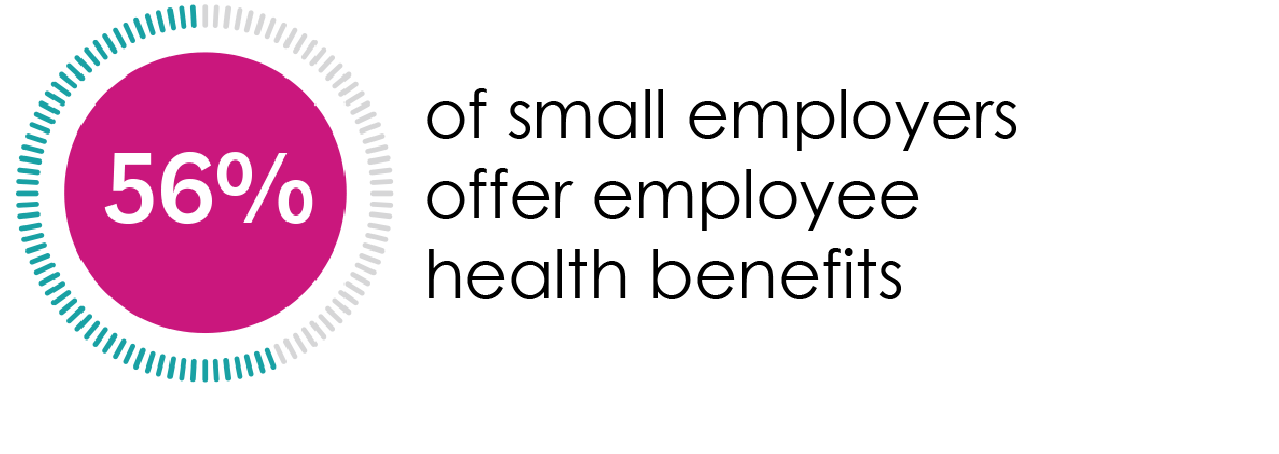

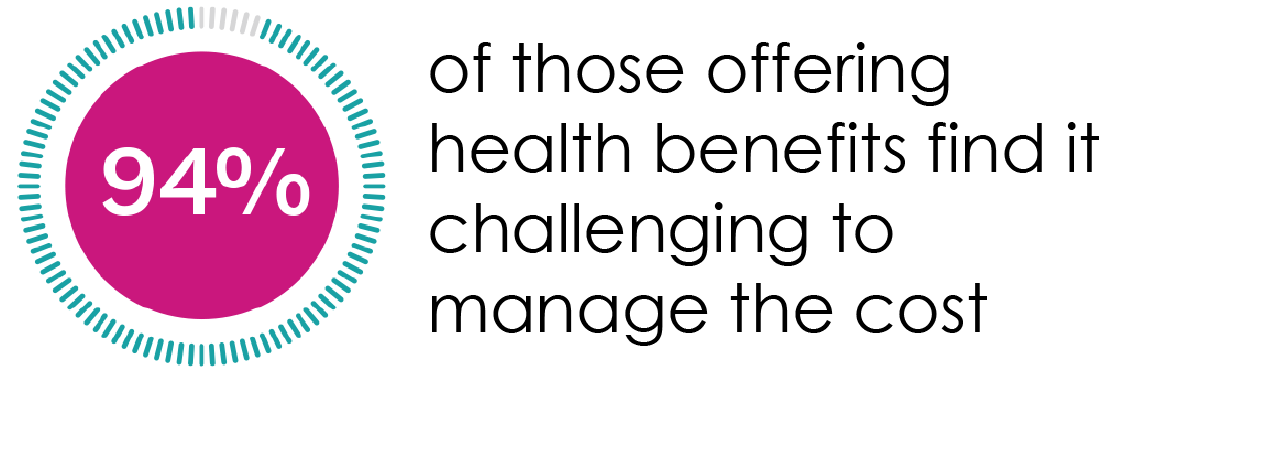

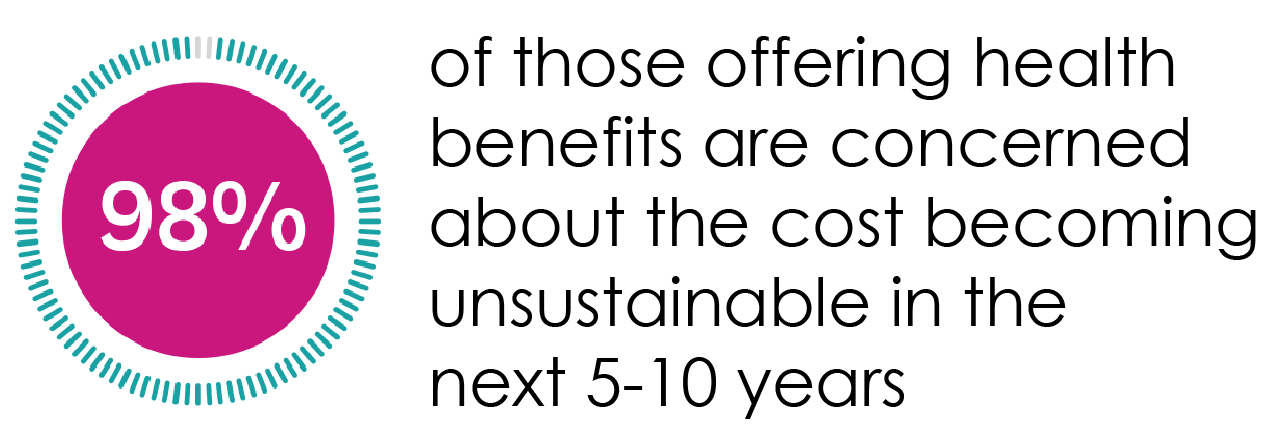

In 2022, 83% of employees rated health benefits as a “very important” or “extremely important” part of their compensation.1 While many businesses understand the value of healthcare benefits, providing coverage is becoming increasingly cost prohibitive.

From 2010 to 2022, the average total premium per enrolled employee increased more than 53% for single (self-only) coverage – from $4,940 to $7,590. For family coverage, it increased more than 58% – from $13,871 to $21,931.2 These increases have forced many small employers to drop healthcare coverage from their benefits packages.

How ICHRA Can Help

An individual coverage health reimbursement arrangement (ICHRA) is a smart, ACA-compliant alternative to group insurance. ICHRA allows employers of all sizes to directly reimburse employees for individual health insurance premiums and qualifying medical expenses tax free.

The process is easy for both employers and employees.

- Employers choose a benefits solution provider and define their contributions.

- Employees shop and enroll in whatever available plan works best for them and receive reimbursements for coverage.

ICHRA coverage can benefit your business through:

- Consistent savings. Save on the cost of employee health benefits and take the uncertainty out of year-over-year expenses and increases.

- Easy administration. Simplify the process of managing health benefits, resulting in less time on administration and more time on growth.

- Greater choice. Boost recruitment and retention by giving employees better options.

And it avoids the challenges that come with traditional group insurance because it does NOT require:

- Procuring bids for group coverage

- Changing plans annually

- Negotiating rates

The Problem for Small Businesses

Finding the Right Solution

From 2022 to 2023, the number of employers with at least 50 full-time employees offering ICHRA plans increased 144%, according to the HRA Council.3 This means that hundreds of thousands of employees currently receive their health insurance through ICHRA. Your employees could be among them.

Contact Us

Want to learn more about how an ICHRA plan can help your business provide flexible and affordable insurance to your employees?

About Us

Ambetter Health is the largest carrier of Marketplace insurance in the country,† serving nearly 5 million members. At our core, we believe in providing high-value, low-cost health benefits without compromise.

1. State of Work/Life Balance Benefits.External Link Society for Human Resource Management. June 2023. SHRM Executive Network.

2. Adam Grundy, Kevin McLain and Yi Zelibor. How Many U.S. Businesses Offer Health Insurance to Employees?External Link United States Census Bureau. Feb. 2024.

3. Growth Trends for ICHRA and QSEHRA 2022 to 2023.External Link HRA Council. June 2023.

†Statistical claims and the #1 Marketplace insurance statement are in reference to national on-exchange marketplace membership and based on national Ambetter Health data in conjunction with findings from 2023 Rate Review data from CMS, 2023 State-Level Public Use File from CMS, state insurance regulatory filings, and public financial filings.