NEED HEALTH INSURANCE? SHOP OUR PLANS.External Link

You may be eligible to save money on your health insurance premium and lower your monthly bill.

What is an Advance Premium Tax Credit (APTC)?

APTC is a type of financial assistance from the government that can help you save on your monthly premium payment. The tax credit, if you’re eligible, will go towards reducing your monthly premium. Your premium payment is what you pay each month for your monthly bill.

External Link

External Link

What is a subsidy? A subsidy is financial assistance provided by the federal government that helps lower what you pay for health insurance each month (your premium). The size of your family, where you live, and your income are the three things that determine your subsidy. See if you qualify: Enroll.Ambetterhealth.comExternal Link

Do You Qualify?

Your eligibility is based on your household size, where you live, and estimated income along with other factors.

The amount of premium tax credit you may be eligible for is based on how your household income compares to Federal Poverty Levels. Federal Poverty Level (FPL) is the minimum income a family requires for basic needs like food or shelter. The government decides these FPL levels. You can check the levels on the Department of Health and Human Services websiteExternal Link. The FPL range may change based on the state you live in.

Even if you've checked your eligibility for subsidies in previous years, look again now. See what savings you may be eligible for.External Link

Important Tax Information for Advanced Premium Tax Credit (APTC)

Advanced premium tax credit (APTC) helps you save on your Ambetter Health premiums. Here's a reminder about the two important forms you'll need when you file your return this year.

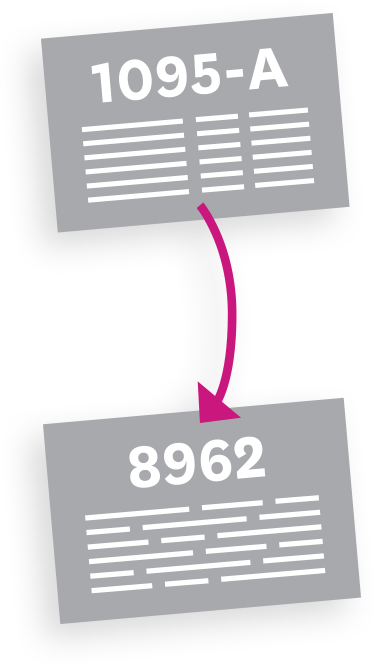

You’ll receive a 1095-A Health Insurance Marketplace Statement. You should see this form in the mail by mid-February. You can also download your 1095-A through your Healthcare.govExternal Link account.

Use your 1095-A to file Form 8962 with your tax return.

These two forms will determine the amount of your tax credit. You can access a paper form here.

Using these two forms to file your taxes correctly and on time is very important!

If you don't, you may lose your tax credit, resulting in higher premiums and possible loss of coverage. Don't forget: the filing deadline for your federal taxes is April 15, 2025.

Frequently Asked Questions:

The APTC can help make your healthcare premiums more affordable, with an average credit amount of $491 per month.

To be eligible:

- Your household income for the year has to be between 100-400% of federal poverty line (FPL)

- You can’t be eligible for a government program, e.g., Medicaid, Medicare, CHIP, or TRICARE

- Your tax return filing status can’t be “Married Filing Separately.”

If you had a Health Insurance Marketplace plan in 2024, you should get Form 1095-A (Health Insurance Marketplace Statement) by mail no later than mid-February.

Your 1095-A may also be available in your HealthCare.govExternal Link as soon as mid-January.

Your 1095-A includes information about Marketplace plans anyone in your household had in 2024, so you may receive multiple 1095-A forms if family members enrolled in different plans. You must have your 1095-A before you file, so don’t file your taxes until you have an accurate 1095-A.

- You changed Marketplace plans during the year

- You updated your application with new information — like adding or removing a family member, or moving — that resulted in a new enrollment in your plan

- Different household members had different plans

- If there are more than 5 members on the same plan

Visit healthcare.govExternal Link for more information.

You’ll get a 1095-A too. Part III, Column C should be blank or have the number “0.”

If you want to see if you qualify for a premium tax credit based on your final income, you can complete Form 8962 (PDF) to find out. If you don't qualify for a premium tax credit, you don't have to include Form 8962 when you file your income taxes.

Your 1095-A should include information for only the months you had a Marketplace plan.

The "monthly enrollment premium" on Form 1095-A (Part III, Column A) may be different from the monthly premium you paid. This doesn’t always mean there are errors, because:

- Your plan included benefits in addition to the essential health benefits required by the health care law, like adult dental or vision benefits. In this case, the monthly enrollment premium on your Form 1095-A may show only the amount of your premium that applied to essential health benefits.

- You or a household member started or ended coverage mid-month. In this case, your Form 1095-A will show only the premium for the parts of the month coverage was provided.

- You were enrolled in a stand-alone dental plan and a dependent under 18 was enrolled in it. In this case, the monthly enrollment premium on your Form 1095-A may be higher than you expect because it includes a portion of the dental plan premiums for pediatric benefits.

No, you will either received a 1095-A or a 1095-B, depending on which type of Ambetter Health plan you enrolled in. 1095-A Form will come from Healthcare.gov and are for members who purchased their plans through Healthcare.gov, either directly or through a broker. 1095-B Form will come from Ambetter Health are for members who purchased their plans directly from Ambetter Health and receive no APTC.

Ambetter Health will mail tax Form 1095-B to everyone who had individual or group health coverage with us in 2024. This includes:

- Individual & Family Plans, off-exchange.

- Catastrophic plans, on-exchange.

If you are enrolled in an individual on-exchange plan (with the exception of catastrophic plans), or a Medicare plan you will not receive a 1095-B form.

Ambetter Health also sends the information gathered on the Form 1095-B to the IRS and to your State Franchise Tax Board. It is recommended that you save this form with your tax records and show it to your tax preparer, if you use one.